Payment Processing Guidelines

(A to Z at Student Business Services)

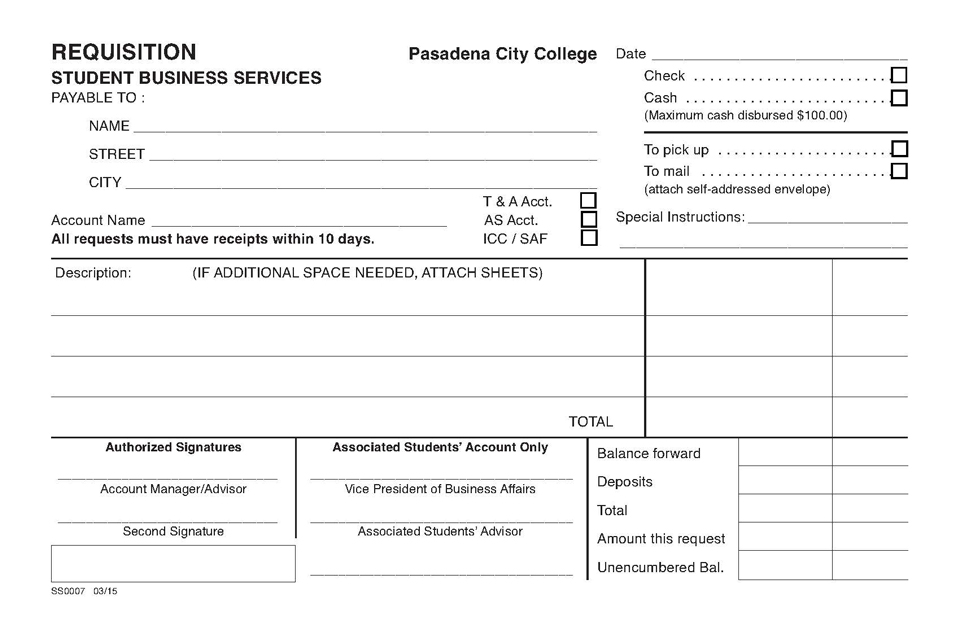

What is a Requisition?

A requisition is a formal request to purchase goods, services, or resources.

Requisitions are submitted to Student Business Services for the following:

- Payments to vendors for goods or services

- Student and employee payment reimbursement (e.g., goods purchased, travel expenses)

- Cash Advance Request

- Change Fund Request

To process your request, the SBS Requisition Request form must be fully completed, signed, and the club or program responsible for the expense must have sufficient funds. Additionally, all required documentation must be submitted.

General Guidelines:

- A minimum of two signatures is required on all payment requests.

- Additional signatures are required for Student Trust & Agency and Associated Student accounts.

- You cannot approve your own reimbursement.

- Submit original receipts with all payment reimbursement requests.

- A check will be issued for reimbursements over $100.

- Processing will take up to 5 business days from the date SBS receives your request.

- Only payments to vendors, students, and employees are allowed.

- Employees and students must present a photo ID to pick up their checks.

- For internal control purposes, all vendor payments will be mailed.

- An approved service agreement is required for all services and must be approved by the designated approver (Darlene Inda or Jessie Wang) before services begin.

- When submitting invoices, please include either a packing slip or a signed statement on the invoice confirming that all items have been received or that services have been completed. For example: “All items received or services completed—approved for payment,” followed by your signature.

- For cash advances, provide a clear explanation of the purpose. Example: “Cash advance for supplies for [event name] on [date].” Receipts and/or unused funds must be returned within 5 business days. New advances will not be issued until prior ones are reconciled.

What is a cash advance?

A cash advance is a sum of money provided upfront to cover expenses, typically for travel or business purposes, which must be repaid with receipts and/or unused funds returned.

Cash Advance Guidelines:

Cash advances should only be requested for purchases from vendors that are unable to invoice the college.

Original receipts and/or unused funds must be submitted to SBS within 5 days of receiving the cash advance.

A new cash advance will not be issued until the previous one has been reconciled.

For student travel, it is recommended that club advisors submit a requisition in advance to request direct payment for hotel accommodations and conference registration fees. Advisors should only request a cash advance for meals, transportation, and other incidental travel expenses. This process eliminates the need to carry large sums of cash, reducing the risk of loss and ensuring that the advisor is not responsible for handling significant amounts of funds during the trip.

Students requesting a cash advance to purchase goods must have an approved “Funds Advance Student Legal Agreement” form submitted with their requisition.

What is a Change fund?

A change fund is a set amount of cash kept on hand to provide change during event transactions.

Change Fund Guidelines:

- Email SBS a week before the event with the amount you're requesting, the cash denominations, and the event date. We will respond with the date the funds will be available for pickup.

- Bring your approved requisition with you to pick up the change fund.

- Only an authorized signer can pick up the change fund.

- Return change funds along with your cash deposit and reconciliation documentation the following business day of the event.

What is a payment reimbursement request?

A payment reimbursement request is a formal request submitted by an individual for expenses they have personally paid on behalf of the organization or program. The request typically includes documentation, such as receipts or invoices, to support the expense and ensure that it complies with the organization's reimbursement policies.

Payment Reimbursement Guidelines:

Employees/Students should not pay vendors that can invoice the college due to the following issues:

- Use Tax may not be reported.

- Payments for services or customized products are considered payments for services and may be subject to 1099 or EDD reporting.

- Payments more than $1500 to Nonresidents for rentals located in California or for services performed in California are subject to a 7% withholding rate. If the vendor is exempt from withholding, they must complete California Form 590, Withholding Exemption Certificate.

SBS should process payments to vendors directly to ensure compliance with federal, state, and local laws and regulations. This helps maintain accurate financial records, supports proper auditing, and ensures adherence to funding guidelines, particularly for grants and other regulated funds.

For Student Business Services (SBS) to process your request, the SBS Requisition must be properly completed and signed, and the club or program paying for the expense must have funds available for payment. In addition, all required documentation must be submitted.

- Enter the following:

Date, Name, Address, Full Account Name

Include Employee/Student ID# if applicable - Check the boxes that apply to this request.

- Enter Description that explains what the payment is for and the purpose.

Example:

“Reimbursement for supplies purchased for the PCC 100 Centennial Celebration held on September 28, 2024.” - Enter transaction amounts and total.

- Enter Balance forward (Funds Available)

- Obtain Authorized Signatures for approval.

- Submit Requisition with required documentation.

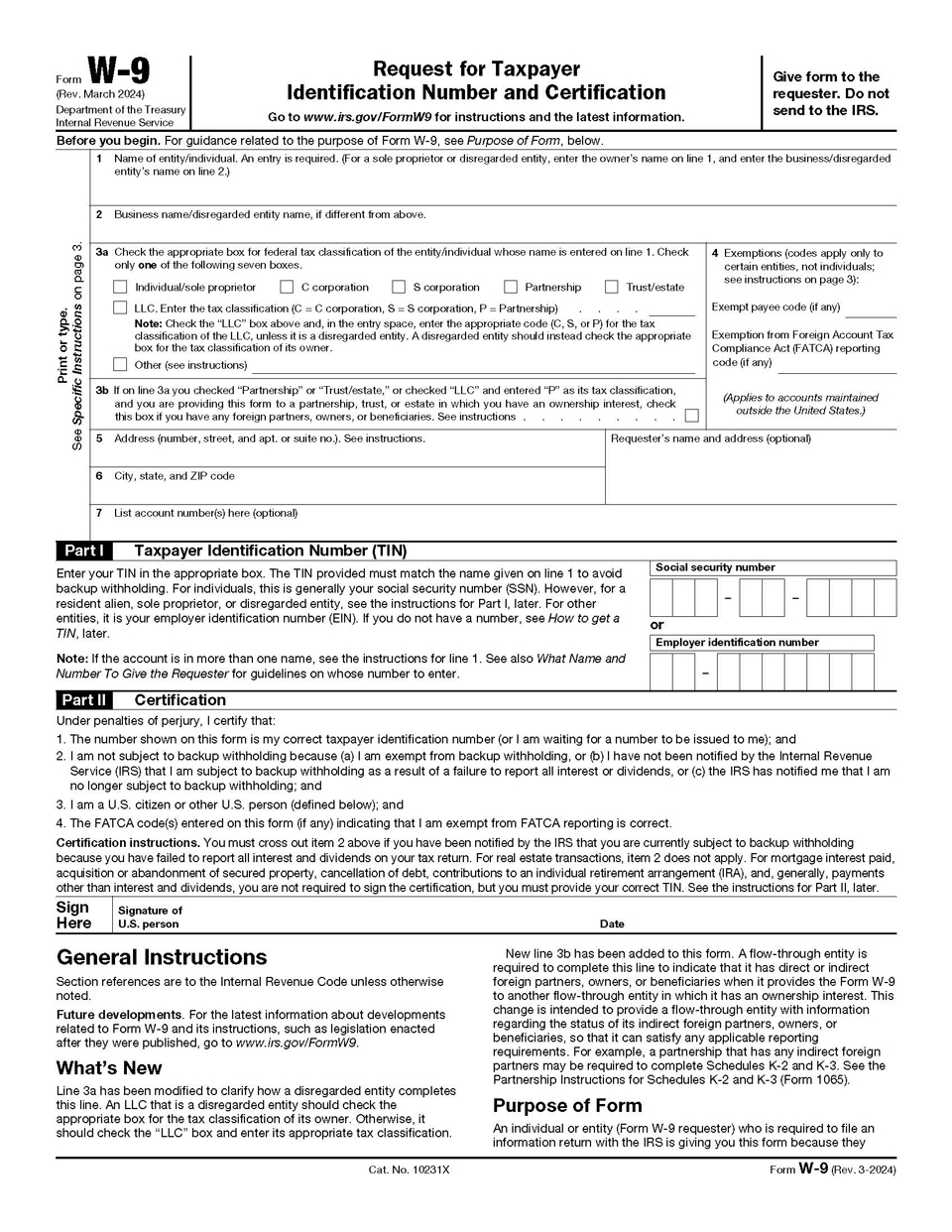

Form W9 - Request for Taxpayer Identification Number and Certification

- Required for all payments to vendors.

- Used for reporting purposes.

- If vendor’s federal tax classification is marked individual, an SSN is required for EDD reporting (see index for further information).

- For Sole proprietors, the owner’s name goes on Line 1 and the Business name goes on Line 2.

- Form W-9 2024

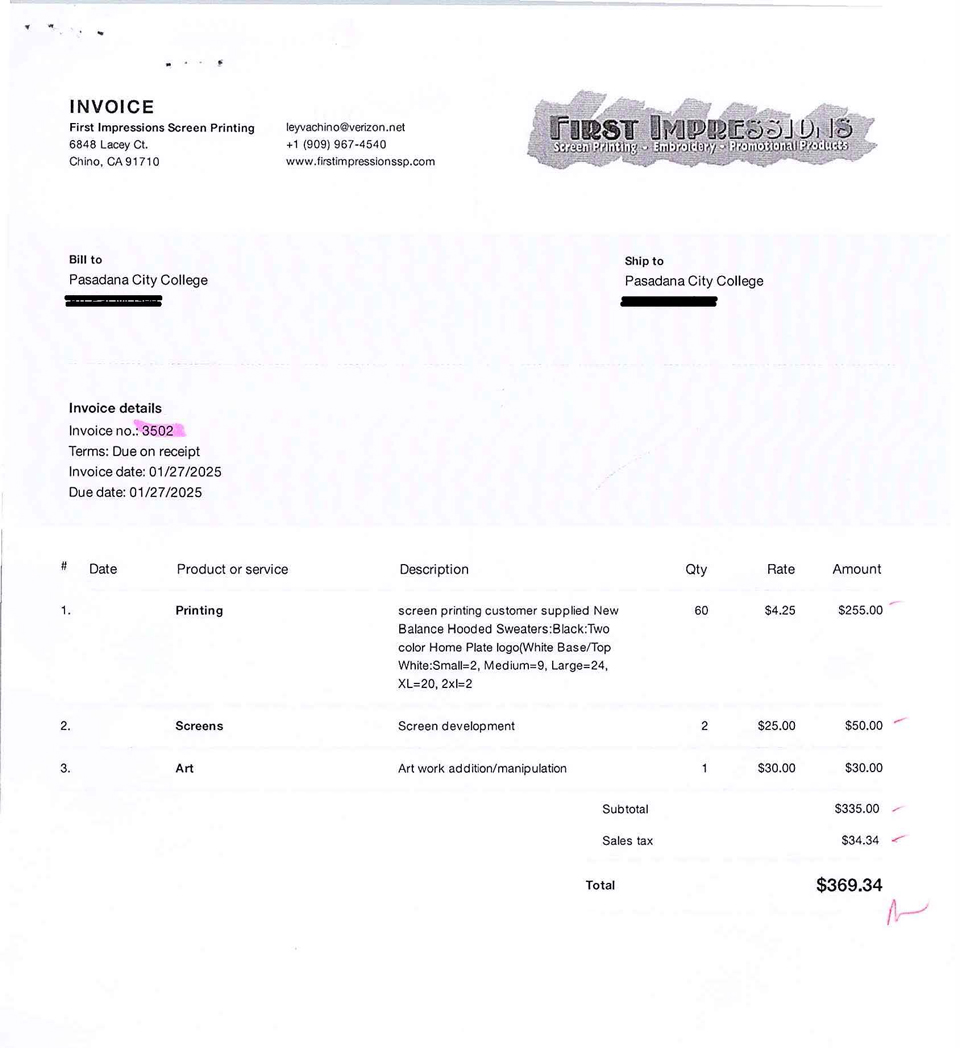

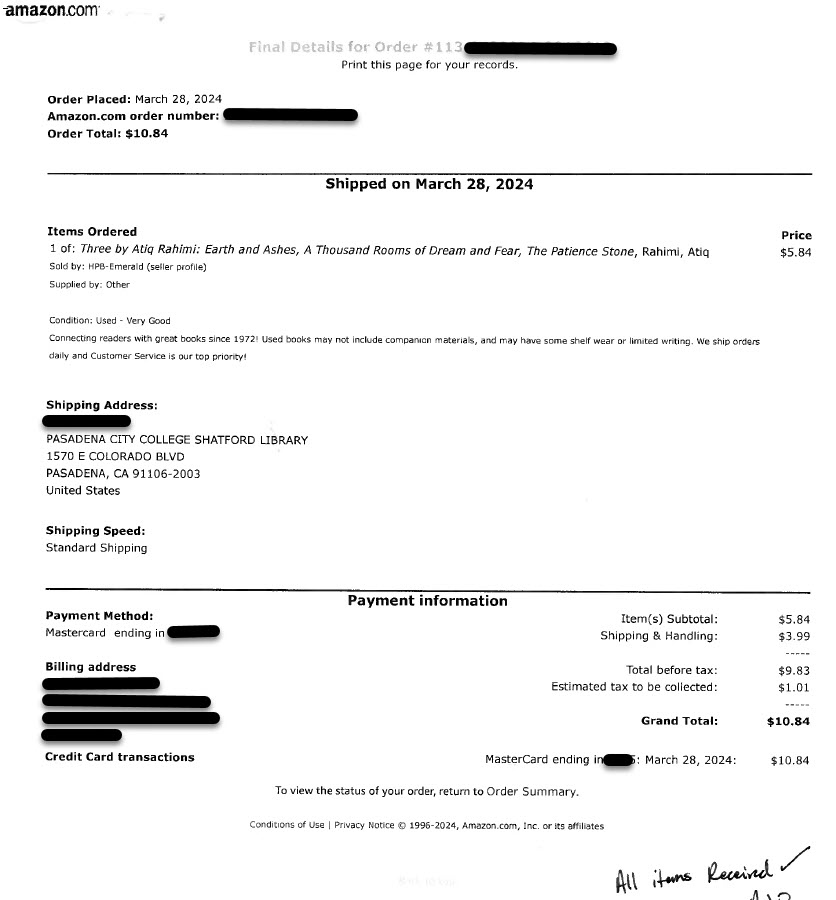

Vendor Invoice - Document from the seller to the buyer detailing products or services, quantities, prices, payment terms, and the total amount due, serving as a request for payment and a record of the transaction.

- Required for all payments to vendors.

- Employees should not be creating invoices for independent contractors.

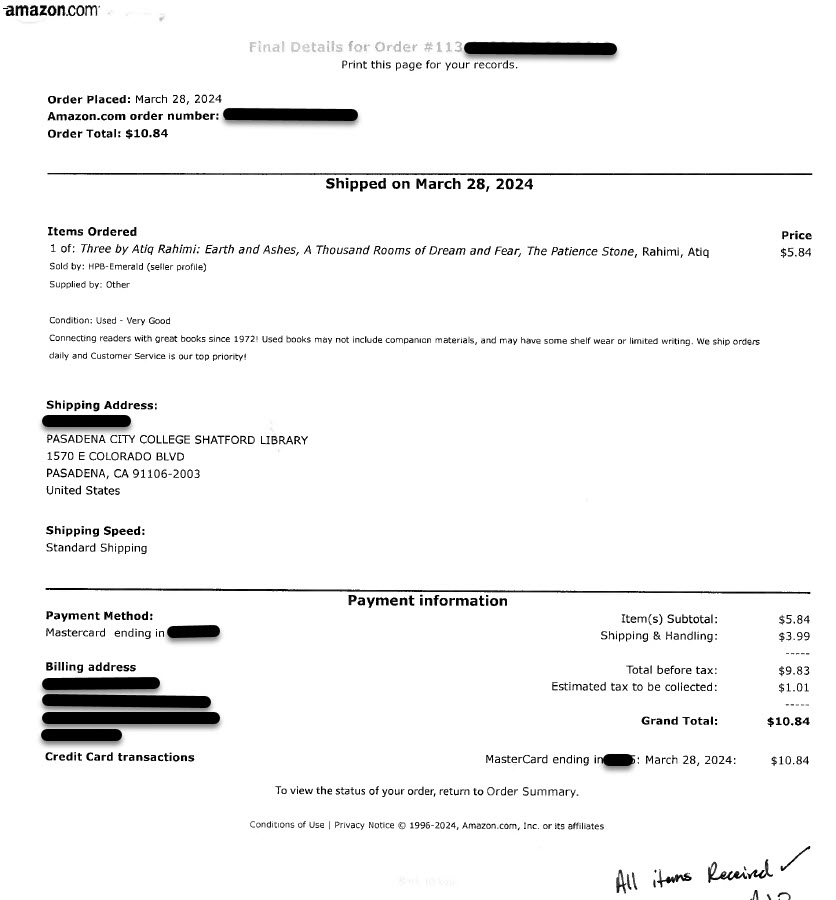

- If an employee or student has paid the invoice, they must submit the invoice along with their reimbursement request. The invoice should include proof of payment

- When submitting invoices, please include either a packing slip or a signed statement on the invoice confirming that all items have been received or that services have been completed. For example: “All items received or services completed—approved for payment,” followed by your signature.

Receiving Documentation - Such as a Packing Slip that lists the items included in a shipment used to verify

the contents upon receipt.

If there is no packing slip included in the shipment, you can indicate on the invoice

that all items have been received and approved for payment, followed by your signature.

Please note: All items should be shipped to PCC.

- Itemized receipts are required for all payment reimbursement requests.

- Itemized receipts are not required for meals covered by per diem.

- Receipts must show proof of payment. If your receipt does not confirm proof of payment, a credit card statement or bank statement can be used as proof of payment.

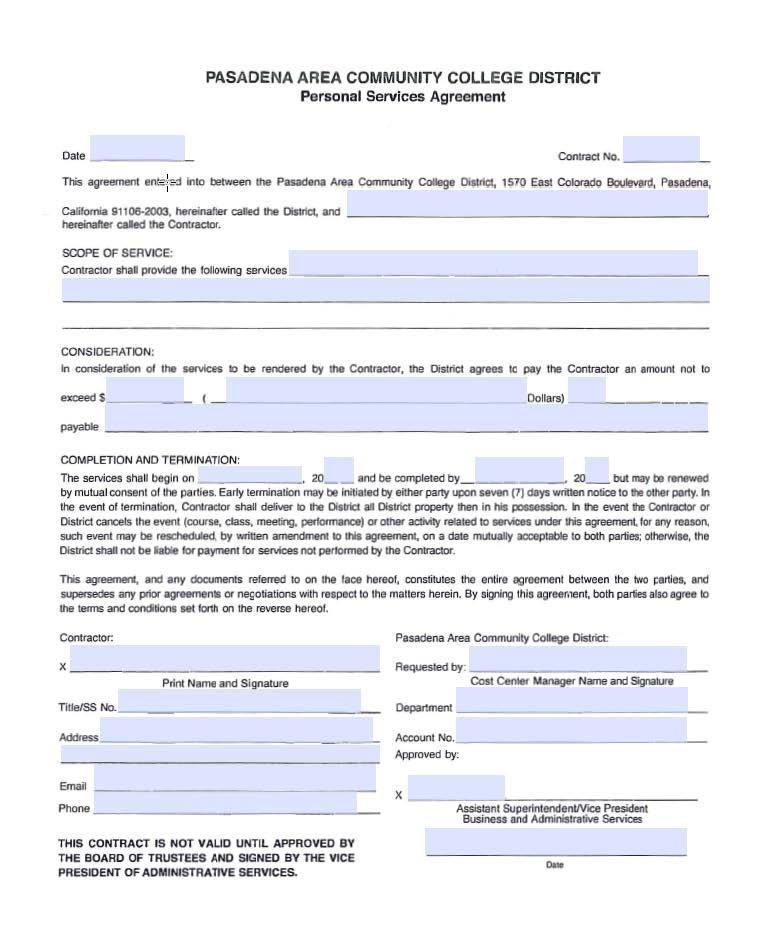

Service Agreement - A service agreement is a contract between a provider and a client that outlines the terms, conditions, scope of services, and includes a release of liability.

- A service agreement is required for all services and must be approved by the designated approver (Darlene Inda) before any services begin.

- Proof of insurance is required; however, if the vendor signs the service agreement, the college is not held liable.

- Volunteers (providing services at zero charge) are still required to complete a service agreement.

- Rental companies typically have/use their own templates, which are very disadvantageous to the district and place all liability on PCC. Please start the process early to allow sufficient time to revise templates.

Services should only be performed by an independent contractor, not by employees or students.

- IRS - Independent Contractor Defined

- State of California - What is the ABC test?

- EDD - Employment Status

Payments to students for services performed can be processed through the Foundation as a scholarship or honorarium.

Payments to students processed through SBS require HR’s confirmation that the student is not working as a student worker. If the student is an active student worker, the payment must be processed through payroll. This is because the student will receive a W-2 from the District and possibly a 1099 from Associated Students for services performed (although they are not independent contractors).

If the student needs to be paid through payroll, please contact SBS for the T&A advance account string. Please note that Fiscal Services will bill the T&A account for payroll reimbursement.

All software purchases and software licenses, including those for web-based software with no integration to Banner or other systems, require ITS approval. ITS will verify that there are no security concerns and that the purchase does not duplicate existing solutions. Please submit a technology purchase request (TPR) for approval prior to making any technology or software licensing purchases.

ITS will submit a Contract Request Form (CRF) on your behalf if your software purchase includes a contract or an agreement.

An ITS Project Request form is required for software purchases over $5,000 or those requiring integrations with other systems. This allows ITS to evaluate the purchase and plan necessary integrations.

For all services exceeding $5K, the department should submit a Contract Request Form (CRF) in Fresh Service @ https://helpdesk.pasadena.edu/support/catalog/items/98

W-9, rates, and proof of insurance will need to be submitted with CRF.

When submitting a CRF include the A.S./T&A account string and indicate that this is an A.S. or T&A account number.

For subscription only, no CRF is needed. If it involves maintenance, updates… then a CRF, ITS approval, and agreement are needed, whether the cost is less or greater than $5K.

Required for the following:

- Overnight Travel

- Exceeds $5,000 in expenses for student group travel

- Exceeds $1,500 in expenses for individual student travel

- T&A Service Agreements that exceed $3,000 are submitted to Purchasing for board approval.

All purchases must comply with applicable laws and College Board policies.

- Must be pre-approved.

- Purchases must be outside of what the community college is expected to provide or has previously provided from its own general funding sources.

- Must benefit a group of Individuals (with few exceptions).

Examples from FCMAT:

- Student magazines and newspaper subscriptions

- Supplemental equipment for student use not provided by the college (e.g., telescopes)

- Field trips/excursions - Unless part of the curriculum, students receive class credit for them

- Extracurricular costs for athletics (e.g., costs for ticket sales, game officiating, and security)

- Social events for students

- Awards if there is a college policy allowing them

Unallowable Expenses:

All purchases must comply with applicable laws and College Board policies.

- Gratuity more than 15% of the subtotal

- Payments to staff for services performed

- Payments to students for services performed

- Alcohol purchases

Examples from FCMAT:

- Curriculum and classroom supplies

- Expenses that are the college’s responsibility, including trips that are listed in the instructor’s syllabus, and students receive class credit

- Repair and maintenance of college equipment/facilities

- Items for employee personal use

- Faculty meeting costs

- Employee clothing/attire

- Large awards unless specifically approved in the board policy

- Employee appreciation meals

- Donations to other organizations, families, or students in need

- Gifts of any kind

- Student T&A Accounts

Must promote the students’ general welfare, morale, and educational experience. - Non-Student Related T&A Accounts

Example: ALE, CFT, and Department T&A accounts

There are a few exceptions to unallowable expenses.

- Student T&A Accounts

Board Policies

Please reference the following board policies for additional information on allowable and unallowable expenses, purchasing, travel, and delegation of authority.

AP 6302 - Purchases of Food and Refreshments

AP 6330 - Purchasing and Inventory

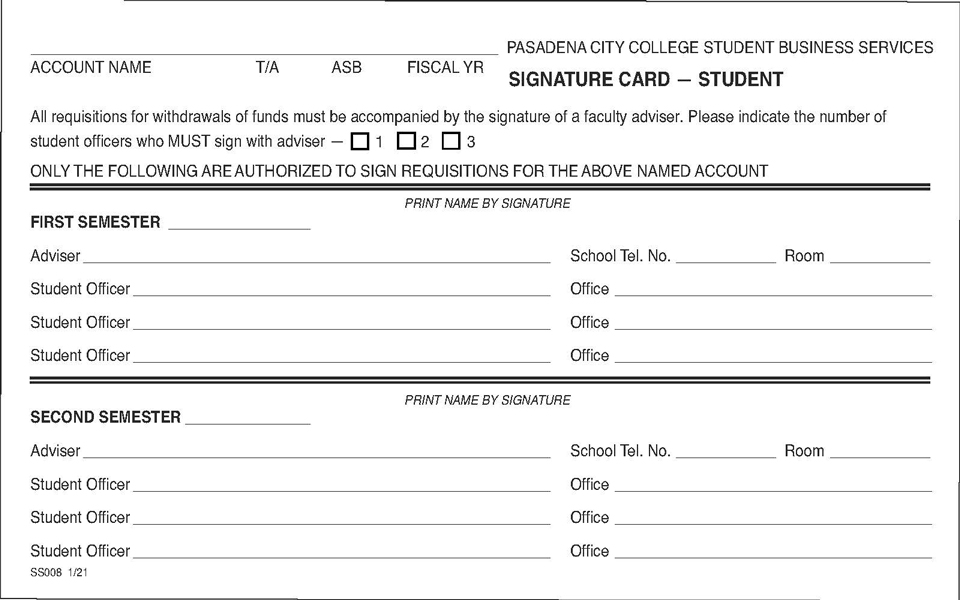

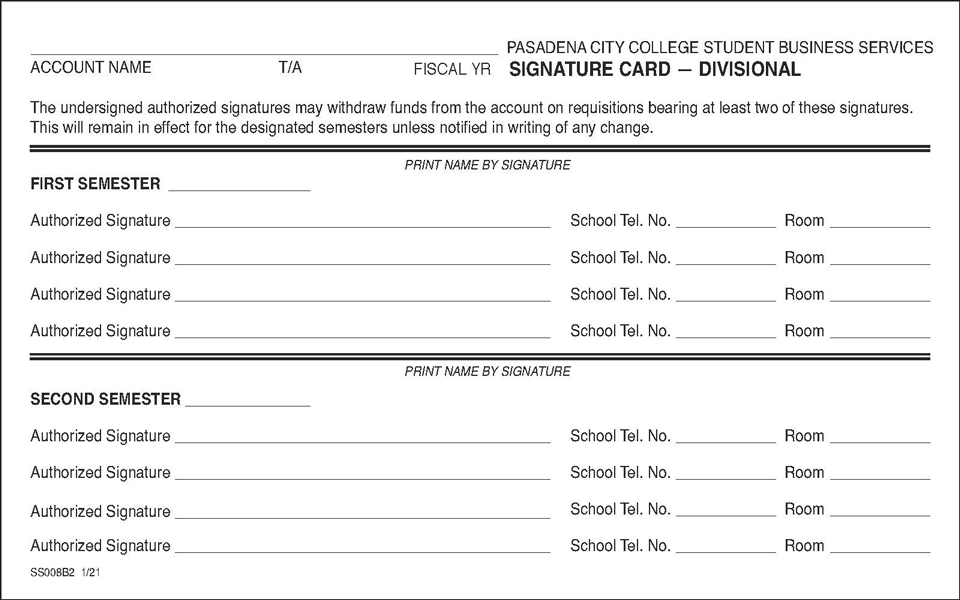

Signature cards designate who is authorized to submit payment requests and request account information.

- A signature card is required for each fiscal year.

- Your signature card must be on file in our office before any expenditures are made from your account for the new fiscal year.

- You may sign for both the Fall and Spring semesters if you do not anticipate any changes.

- Please print the names of the signers next to their signatures on the card.

- Your signature must match the signature on the requisitions submitted.

- We recommend that at least three people sign the signature card.

- If you have any changes in authorized signers, please notify SBS, and we will send you a blank signature card for the new authorized signers.

- Every cash transaction should be properly recorded (cash log, register, Excel Spreadsheet).

- Cash should be stored in a secure area.

- Change funds and cash deposits must be returned to SBS by the next business day following the event. This reduces the amount of cash kept on-site and minimizes the risk of theft or loss.

- For fundraisers that involve collecting cash over an extended period, please make frequent deposits. SBS has received checks that were dated 2 to 3 months earlier, highlighting the importance of timely deposits to ensure proper tracking and to avoid any delays or issues with outdated checks.

- All checks should be made payable to Pasadena City College and not to an individual’s name or a club’s name. In the memo section, please include the club/fundraising event name.

- Under no circumstances may any cash from the event or fundraiser be used to purchase items or reimburse expenses. All funds received must be deposited.

Student Business Services is required to report single-member LLCs; therefore, the individual must provide their Social Security Number (SSN) on Form W-9.

The following has been copied from edd.ca.gov:

Businesses and government entities (defined as a "service-recipient") need to report information to the Employment Development Department (EDD) on independent contractors (defined as a "service-provider"). This information helps track parents who owe child support. For more information, refer to our e-Services for Business FAQs or the Electronic Filing Guide for the Independent Contractor Reporting Program (DE 542M) (PDF).

You are required to report independent contractor information if you pay compensation or enter into a contract with an independent contractor, and the following statements all apply:

- You are required to file a federal Nonemployee Compensation (Form 1099-NEC) or a Miscellaneous Information (Form 1099-MISC) for the services performed by the independent contractor.

- You pay the independent contractor $600 or more, or enter into a contract for $600 or more.

- The independent contractor is an individual, sole proprietor, or single-member LLC.

Reporting Requirements

You must report independent contractor information to us within 20 calendar days if either of the following applies:

- You paid $600 or more to an independent contractor in any calendar year.

- You enter into a contract for $600 or more with an independent contractor in any calendar

year, whichever is earlier.

Independent contractors must be reported once per calendar year for any new or ongoing contracts.

If you are submitting reports online, you must submit 2 monthly reports that are not less than 12 days and not more than 16 days apart. Independent contractors should only be reported once per calendar year for any new or ongoing contracts.

What to Report

Independent contractor (Service-Provider):

- First name, middle initial, and last name

- Social Security number

- Address

- Start date of contract (if no contract, date payments equal $600 or more)

- Amount of contract, including cents (if applicable)

- Contract expiration date (if applicable)

- Ongoing contract (check box if applicable)